401k employer contribution calculator

Ad Discover The Traditional IRA That May Be Right For You. The annual elective deferral limit for a 401 k plan in 2022 is 20500.

How Much Can I Contribute To My Self Employed 401k Plan

Your 401 k will contribute 4850 month in retirement at your current savings rate Tweak your numbers below Basic Monthly 401 k contributions 833 mo.

. Visit The Official Edward Jones Site. For example lets assume your employer provides a 50 match on the first 6 of your annual salary that you contribute to your 401 k. Learn About Contribution Limits.

401 k Early Withdrawal Costs Calculator Early 401 k withdrawals will res See more. Calculator Definitions Annual salary The sum of your annual pay before any deductions such as tax. Your Monthly 401k Contribution.

Build Your Future With a Firm that has 85 Years of Retirement Experience. Definition of a 401k Account. Ad Discover The Traditional IRA That May Be Right For You.

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. According to Fidelity the average employer match is 46. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

A percentage of the employees own contribution and a. Employer 401 match programs usually incorporate two figures when calculating a total possible match contribution. Ad Learn More About 401K Contribution Limits and How You Can Maximize Savings for Retirement.

Using the calculator In the following boxes youll need to enter. To figure the amount that your employer will withhold to contribute to your Roth 401 account you need to know your gross pay per pay period and the amount of your income youve. Knowing how much you need to.

Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Individual 401 k Contribution Comparison. And the more money you.

They may get to that percentage using a dollar-for-dollar contribution or a custom formula that might for example. Plan For the Retirement You Want With Tips and Tools From AARP. Build Your Future With a Firm that has 85 Years of Retirement Experience.

This 401K calculator does all the work for you including showing you what your employee and employer 401K contributions regular and True Up are throughout the year. Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your account up to the plans maximum amount.

If you have an annual salary of 100000 and. 401k Retirement Calculator Calculate your retirement earnings and more A 401 k can be one of your best tools for creating a secure retirement. If your business is an S-corp C-corp or LLC taxed as such.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. State Date State Federal. Use this calculator to see how increasing your contributions to a 401k can affect your paycheck and your retirement savings.

It is mainly intended for use by US. Salary Your annual gross salary. It provides you with two important.

A Solo 401 k. Use this contribution calculator to help you determine how much you will have saved in your 401k fund when you retire. Use this calculator to see how increasing your contributions to a 401 k 403 b or 457 plan can affect your paycheck as well as your retirement savings.

Dont Wait To Get Started. This calculator has been updated to. Solo 401k Contribution Calculator.

Solo 401 k Contribution Calculator Please note that this calculator is only intended for sole proprietors or LLCs taxed as such. Self-employed individuals and businesses employing only the owner partners and spouses have several options for tax-advantaged savings. Learn About Contribution Limits.

However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to. Use our free calculator at Money Help Center to determine how much you need to save for retirement and how much you need to set aside each month. Your expected annual pay increases if any.

The 401 k Calculator can estimate a 401 k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. How frequently you are paid by your employer. Your Employers Monthly 401k Adding.

Select a state to. New Look At Your Financial Strategy.

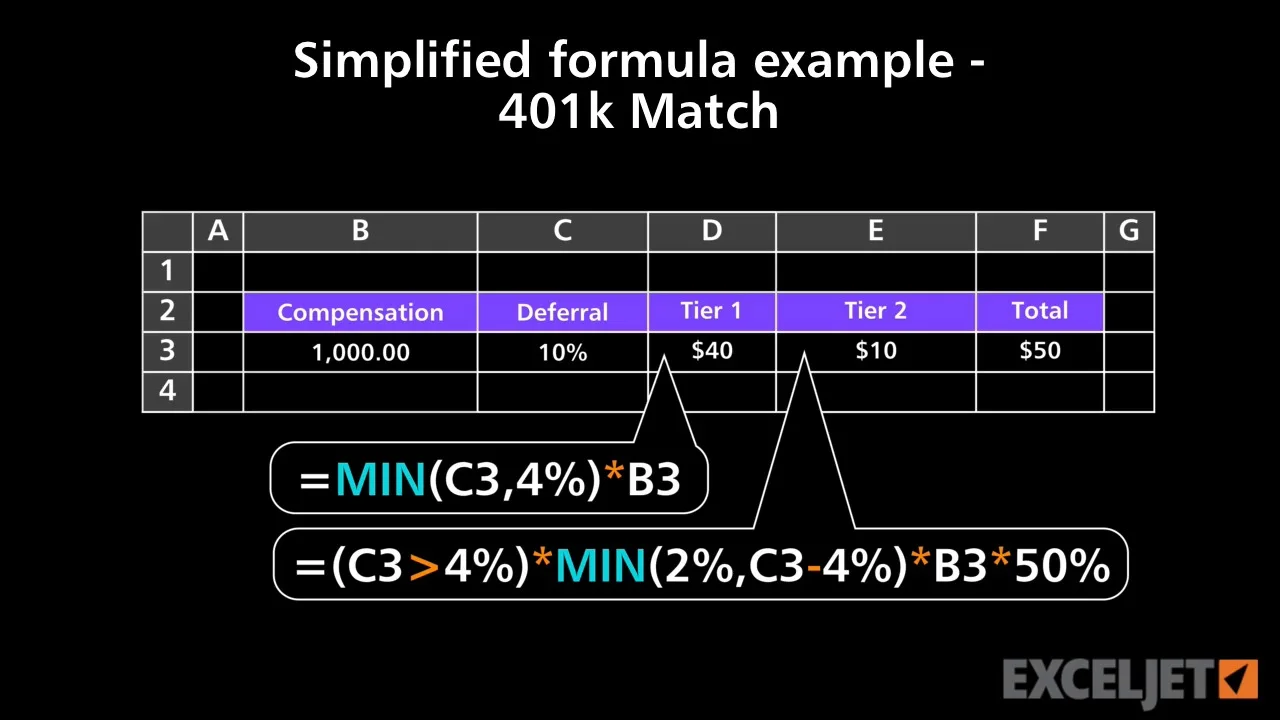

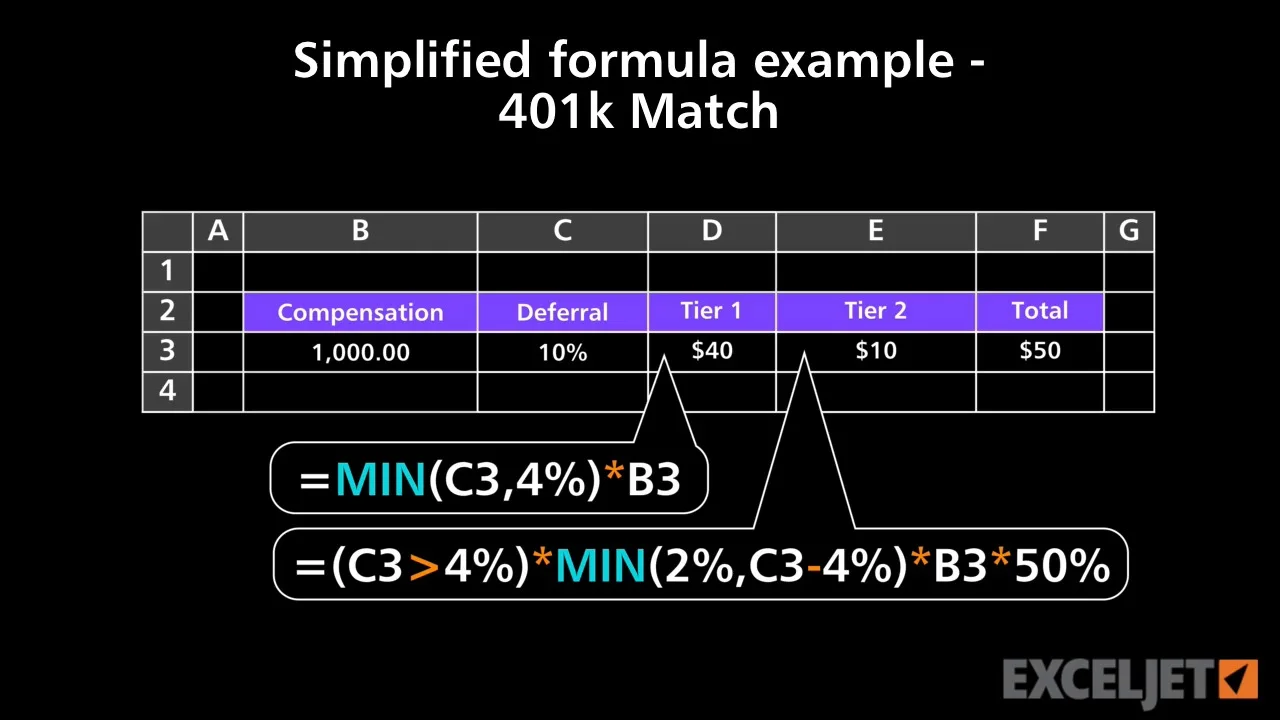

Complex Formula Example 401k Match Youtube

401k Contribution Calculator Step By Step Guide With Examples

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

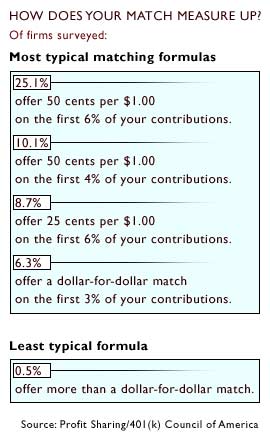

Doing The Math On Your 401 K Match Sep 29 2000

What Is A 401 K Match Onplane Financial Advisors

401k Contribution Calculator Step By Step Guide With Examples

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Doing The Math On Your 401 K Match Sep 29 2000

Excel 401 K Value Estimation Youtube

Retirement Services 401 K Calculator

Free 401k Calculator For Excel Calculate Your 401k Savings

Customizable 401k Calculator And Retirement Analysis Template

401k Employee Contribution Calculator Soothsawyer

Microsoft Apps

Excel Tutorial Simplified Formula Example 401k Match

401k Employee Contribution Calculator Soothsawyer

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community